Key results in 2023

Major business results

In 2023, the consolidated net profit, excluding extraordinary expenses, totalled EUR 3.7 million (2022: EUR 4.1 million). The consolidated net profit decreased by 9% as compared to last year. Including one-off expenses, the consolidated net profit for 2023 totalled EUR 3.4 million. The decrease in net profit is primarily impacted by higher interest rates related to the increase in Euribor and higher depreciation charges related to the Group’s investments. The negative impact of interest costs is twofold and impacts the results as an additional charge of EUR 0.8 million. The results were also impacted by the one-off expenses related to the liquidation of the home delivery service of AS Express Post in the amount of EUR 0.3 million. From July 2023, the home delivery service of Express Post has been discontinued and the Group will no longer incur an additional loss from this area in the upcoming periods.

The comparative base of 2022 is also higher due to the adjustment of fair value of the unpaid future commitment related to the ticket sales platform in the amount of EUR 0.2 million that had been recognised as one-off finance income.

In 2023, the Group employed 976 employees on average which is 92 more as compared to the same period last year (2022: 884 employees). This growth is attributable to 72 employees who were transferred from the companies acquired, incl. ELTA news agency acquired in Lithuania in May 2022 and the news portal lrytas.lt acquired in December 2022. An additional 20 employees were transferred from other companies in Estonia, Latvia and Lithuania.

On 24 February 2022, military action began between Ukraine and Russia. The Group has neither any operations nor any assets in Ukraine and Russia, and therefore, the war has only an indirect impact on the Group. The operations of these countries have an indirect impact on the Baltic economies, including energy prices, raw materials and their overall impact on the economies of Europe and other Western countries.

In 2023, the Group’s cash flows from operating activities totalled EUR 12.2 million (2022: EUR 8.0 million) that were positively impacted by the ticket sales platforms in Estonia and Latvia. The key effect came from Latvia where ticket sales volumes are increasing, despite a weaker economic environment.

In 2023, the Group’s cash flows from investing activities totalled EUR -3.9 million (2022: EUR -10.6 million), of which EUR -3.4 million was related to development and acquisition of property, plant and equipment and intangible assets, indicating higher investments in products and technologies. In 2023, the Group invested EUR -1.2 million in new LED screens, funded with a finance lease.

In 2023, the Group’s cash flows from financing activities totalled EUR -6.2 million (2022: EUR -0.9 million), of which EUR -1.0 million was the share buy-back and EUR -1,5 million was the dividend payment to the shareholders of AS Ekspress Grupp. Financing activities also include a net change in borrowings in the amount of EUR -1.7 million and lease liabilities in the amount of EUR -2.0 million.

At the regular general meeting of shareholders of AS Ekspress Grupp held on 4 May 2023, it was decided to pay a dividend of 5 euro cents per share in the total amount of EUR 1.49 million. Dividends were paid to shareholders on 24 May 2023.

The Supervisory Board of AS Ekspress Grupp has approved the group's dividends policy, according to which Ekspress Grupp will pay at least 30% of the annual profit as dividends starting from 2022.

| Performance indicators (EUR thousand) | 2023 | 2022 | Change % | 2021 | 2020 | 2019 |

| Continuing operations | ||||||

| Sales revenue | 73,086 | 64,141 | 14% | 53,516 | 44,514 | 44,717 |

| Revenue from all digital channels (%) | 83% | 78% | 76% | 70% | 68% | |

| EBITDA | 10,217 | 8,891 | 15% | 8,240 | 5,924 | 4,904 |

| EBITDA margin (%) | 14.0% | 13.9% | 15.4% | 13.3% | 11.0% | |

| Operating profit /(loss) | 5,499 | 4,797 | 15% | 4,864 | 3,071 | 2,337 |

| Operating margin (%) | 7.5% | 7.5% | 9.1% | 6.9% | 5.1% | |

| Interest expenses | (1,499) | (738) | -103% | (709) | (860) | (1,085) |

| Profit (loss) of joint ventures under equity method | (661) | (242) | -173% | (281) | 102 | (38) |

| Net profit from continuing operations ** | 3,691 | 4,055 | -9% | 4,133 | 2,566 | 755 |

| Net margin (%) - continuing operations ** | 5.1% | 6.3% | 7.7% | 5.8% | 1.7% | |

| Return on assets ROA (%) | 3.3% | 4.3% | 2.4% | 2.7% | 1.6% | |

| Return on equity ROE (%) | 6.2% | 7.6% | 4.1% | 4.9% | 2.8% | |

| Earnings per share (euro) - continuing operations | ||||||

| Basic earnings per share | 0.1113 | 0.1335 | 0.1362 | 0.0852 | 0.0249 | |

| Diluted earnings per share | 0.1081 | 0.1294 | 0.1316 | 0.0820 | 0.0249 |

| Balance sheet (EUR thousand) | 31.12.2023 | 31.12.2022 | Change % | 31.12.2021 | 31.12.2020 | 31.12.2019 |

| As of the end of the period | ||||||

| Current assets | 23,094 | 19,444 | 19% | 20,553 | 18,482 | 19,472 |

| Non-current assets | 82,672 | 80,392 | 3% | 73,705 | 75,695 | 75,935 |

| Total assets | 105,766 | 99,836 | 6% | 94,258 | 94,177 | 95,407 |

| incl. cash and cash equivalents | 9,606 | 7,448 | 29% | 10,962 | 6,269 | 3,647 |

| incl. goodwill | 48,166 | 48,779 | -1% | 45,576 | 43,085 | 42,628 |

| Current liabilities | 27,438 | 22,422 | 22% | 20,947 | 18,945 | 21,647 |

| Non-current liabilities | 21,787 | 21,991 | -1% | 19,619 | 20,613 | 22,137 |

| Total liabilities | 49,225 | 44,413 | 11% | 40,566 | 39,558 | 43,784 |

| incl. borrowings (excl rental liabilities according to IFRS 16) | 20,177 | 20,763 | -3% | 17,062 | 19,181 | 21,307 |

| Equity | 56,541 | 55,423 | 2% | 53,692 | 54,619 | 51,622 |

| Financial ratios (%) | 31.12.2023 | 31.12.2022 | 31.12.2021 | 31.12.2020 | 31.12.2019 | |

| Equity ratio (%) | 53% | 56% | 57% | 58% | 54% | |

| Debt to equity ratio (%) | 46% | 46% | 41% | 41% | 47% | |

| Debt to capital ratio (%) | 23% | 24% | 17% | 23% | 29% | |

| Total debt/EBITDA ratio | 1.97 | 2.34 | 2.07 | 2.74* | 3.15* | |

| Liquidity ratio | 0.84 | 0.87 | 0.98 | 0.98 | 0.90 | |

|

* for years 2020-2019 total debt/EBITDA ratio is calculated on the basis of EBITDA, which also includes EBITDA from discontinued operations. ** does not include expenditure related to the closure of home delivery business of the joint venture AS Express Post in the amount of EUR 340 thousand in 2023. |

||||||

| (EUR thousand) | Sales | |||||

| 2023 | 2022 | Change % | 2021 | 2020 | 2019 | |

| Media segment | 73,365 | 62,690 | 17% | 52,093 | 43,728 | 44,218 |

| advertising revenue | 42,074 | 37,613 | 12% | 33,781 | 28,173 | 29,472 |

| subscriptions (incl single-copy sales) | 19,016 | 16,819 | 13% | 13,311 | 11,336 | 10,199 |

| marketplaces | 3,434 | 2,232 | 54% | 1,013 | 851 | 1,368 |

| outdoor screens | 3,530 | 2,396 | 47% | 1,448 | 920 | 1,148 |

| sale of other goods and services | 5,311 | 3,630 | 46% | 2,539 | 2,448 | 2,031 |

| Corporate functions | 2,642 | 4,500 | -41% | 4,118 | 2,761 | 2,076 |

| Inter-segment eliminations | -2,920 | -3,050 | -2,695 | -1,975 | -1,577 | |

| TOTAL GROUP | 73,086 | 64,141 | 14% | 53,516 | 44,514 | 44,717 |

| incl. revenue from all digital channels | 60,460 | 49,928 | 21% | 40,453 | 30,963 | 30,534 |

| % of revenue from all digital channels | 83% | 78% | 76% | 70% | 68% |

The year is characterised by the following digital trends:

* digital revenue growth was strong in all Baltic key markets, customer awareness to pay for digital content keeps increasing;

* artificial intelligence and the tools that are based thereon are increasingly influencing the text, sound and video images;

* focus on ease of use and cyber safety becomes increasingly more important.

Last year, the market for digital subscriptions in Estonia, Latvia and Lithuania developed in the expected direction. Ekspress Grupp, as the largest provider of news media digital subscriptions in the target markets, increased the number of digital subscriptions in the Baltic States by a total of 41% during the year, reaching 207 000 subscriptions by the end of the year. In Estonia, the number of digital subscriptions of Delfi Meedia grew the most, increasing by 20% year-over-year (+17 242) and exceeded the 100 000-subscriber threshold for the first time in December. The number of digital subscriptions of Genius Meedia increased by 25%. Õhtuleht Kirjastus, Delfi in Latvia and Lithuania also continued to ride the growth wave of digital subscriptions, increasing digital subscriptions by 10%, 87% and 112%, respectively, as compared to the previous year. The news portal Lrytas entered the Lithuanian digital subscription market as a newcomer, with over 6 000 subscribers by the end of the year. Rapid growth has been ensured by customers' willingness and awareness to pay for digital content, as one of the biggest leaders in the news field is Ekspress Grupp with its international streaming and music services.

If you compare it to the population of Estonia, Delfi has probably become one of the most successful media companies with a share of digital subscriptions both in Europe and around the world. In 2023, the Lithuanian and Latvian market also witnessed a certain breakthrough in the transition to the digital subscription model, which we had been expecting for some time. The number of Delfi ‘s digital subscribers more than doubled in Lithuania in a year and reached nearly 40 000 subscribers by the end of the year. The number of subscriptions of Delfi in Latvia increased by 87% and reached over 26 000 by the end of the year. The Group's newest media company, Lrytas, switched to a digital subscription model in the last quarter and attained already more than 6 000 subscriptions by the end of the year. These numbers show that, similarly to Estonia, the readers in other Baltic States are also embracing the digital subscription model of journalism and value domestic, independent content produced in their own language. A digital subscription of news media is an increasingly accepted product among the readers, as evidenced by the increasing number of subscriptions and the decreasing turnover of subscribers. We see that more and more readers subscribe to digital news media to keep up with important topics in society.

In 2023, we completed the generation change of the Delfi platform in Latvia and Lithuania. The Group’s central IT development takes place in Estonia, but it concerns all three countries. The platform change in Latvia-Lithuania creates better opportunities and flexibility for readers there. The number of digital subscriptions of Delfi in Latvia and Lithuania was affected because the packages were made to be similar to the ones used in Estonia. A uniform package-based logic was introduced, which gives the digital subscriber greater access to all Delfi content. By now, all Delfi portals have been transferred to the central IT solution, ensuring more economical, safer and faster work results.

In 2023, the revenue of the media segment totalled EUR 73.4 million (2022: EUR 62.7 million). Revenue increased by 17% as compared to the same period last year. At the end of 2023, digital revenue made up 83% of total revenue (2022: 78%).

The Group continues to successfully increase its advertising and digital subscription sales volumes both through an increase in the market share as well as the average price. If to exclude from revenue the acquisitions made in Lithuania in the 2nd half of 2022 (news portal Lrytas and news agency ELTA), media segment revenue increased by 12% in 2023.

Advertising

In 2023, the advertising revenue in Estonia and Lithuania was at an expected level and demonstrated growth while the advertising market remained at the same level as last year. As compared to the same period last year, the advertising market decreased in Latvia where our revenue was 6% lower as compared to last year. The advertising market in Latvia was impacted by the overall negative economic environment, the effects of which we have not been seen to such an extent in Estonia and Lithuania. Digital advertising sales have been growing both in Estonia and Lithuania.

Subscriptions

In 2023, subscription revenue increased by 13% as compared to the same period last year. This growth was primarily boosted by higher subscription volumes and the growth in the average price of subscriptions in all media houses. From the Group’s point of view, it is important to increase digital subscriptions and thereby lower its dependency on advertising revenue over the long run.

Marketplaces

Under marketplaces, the Group recognises the revenue from ticket sales platforms in Estonia and Latvia. In 2023, the revenue from ticket sales platforms increased by 54%. The key contributor is Latvia, where ticket sales volumes are in an upward trend, despite a weaker economic environment. For example, both the number of tickets sold as well as revenue were boosted by the successful ticket sales of the jubilee song festival held in Riga.

Outdoor screens

In 2023, the advertising revenue from outdoor screens increased by 47% as compared to last year. The growth has primarily been boosted by the expansion of the outdoor screen network. In 2023, 64 new screens were added. As of 31 December 2023, the Group had a total of 148 outdoor screens, including 98 in Latvia and 50 in Estonia (31.12.2022: total of 84, 42 in Latvia and 42 in Estonia).

* The number of digital subscriptions of AS Delfi Meedia that publishes the news portal Delfi, newspapers Eesti Päevaleht, Maaleht, Eesti Ekspress and several popular magazines increased by 20% year-over-year and totalled 102 793.

* The number of digital subscriptions of AS Õhtuleht Kirjastus, 50% of which is owned by Ekspress Grupp, increased by 10% year-over-year and totalled 24 875.

* The number of digital subscriptions of Geenius Meedia OÜ increased by 25% year-over-year and totalled 6 998.

* In Latvia, the number of digital subscriptions of Delfi A/S increased by 87% year-over-year and totalled 26 427.

* In Lithuania, the number of digital subscriptions of Delfi increased by 112% year-over-year and totalled 39 872.

* The Lithuanian media portal Lrytas started selling paid content in the 4th quarter of 2023 and reached 6363 digital subscriptions by the end of December.

Last year as a whole and especially the last quarter were very successful for the media publications of Ekspress Grupp. The total number of subscriptions increased by 41 per cent in the Baltic States in a year and totalled 207 000 at the end of December.

On the Estonian market, the number of digital subscriptions of the Group’s largest media company, Delfi Meedia, increased by 20% in a year and exceeded 100 000 subscriber threshold for the first time in December. Compared to the population of Estonia, Delfi has probably become one of the most successful media companies with a share of digital subscriptions both in Europe and worldwide.

On the Lithuanian and Latvian markets, there was also a certain breakthrough in switching to a digital subscription model, which we have anticipated for a while already. The number of digital subscribers of Delfi in Lithuania more than doubled and totalled almost 40 000 subscriptions by the end of the year. The number of subscriptions of Delfi in Latvia increased by 87 per cent and totalled more than 26 000. The newest Lithuanian media company of Ekspress Grupp, Lrytas, switched to the digital subscription model in the last quarter and had already more than 6000 subscriptions by the end of the year. These figures demonstrate that, similarly to Estonia, the readers of other Baltic States are also adopting the digital subscription model of journalism and value domestic, independent content produced in their own language.

The digital revenue base of Ekspress Grupp is increasingly based on digital subscription revenue. The Group is making progress in attaining our financial goals and wish to offer digital paid content to at least 340 000 subscribers by the year 2026.

Statement of the chairman of the management board

The year 2023 was full of challenges, which we were able to overcome thanks to our dedicated work and the right strategic decisions, achieving significant progress and strengthening our position as the leading digital media company in the Baltic States.

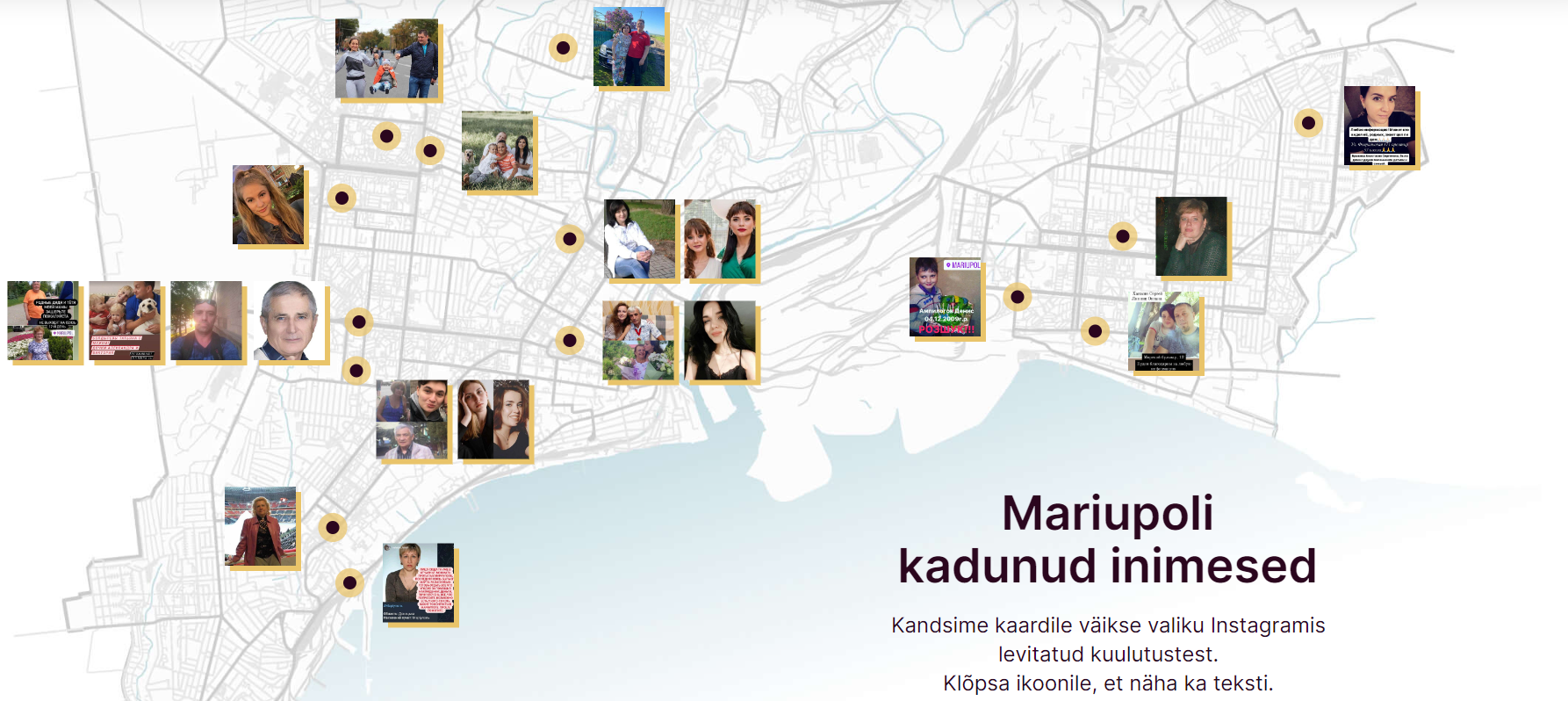

One of the key challenges is the continuation of the war in Ukraine. This significantly affects entire Europe, including Estonia. In our media company, we have had to learn new ways of covering the conflict and how to ensure the safety of journalists and the coverage of reliable news. We have also had to deal with propaganda and cyber-attacks. Last year, Ekspress Grupp's media outlets largely focused on ensuring that the coverage of the war would not show any signs of fatigue. We need to find new angles to keep our readers interested – this is how we can make our best contribution to support Ukraine.

In 2023, we also adhered to our mission to serve democracy, and provide a high-quality and unbiased news feed. Our readers appreciate it highly, and the value of quality news content will continue to grow over time. The highlight of the year 2023 was artificial intelligence (AI), and the benefits and problems associated with it. Content production has never been that easy, but in the future content will become less important than those who publish it. Credibility will become an even more valuable currency, and media companies will play an even more important role in filtering misinformation.

– Mari-Liis Rüütsalu, Chairman of the Management Board